Page 8 - Demo

P. 8

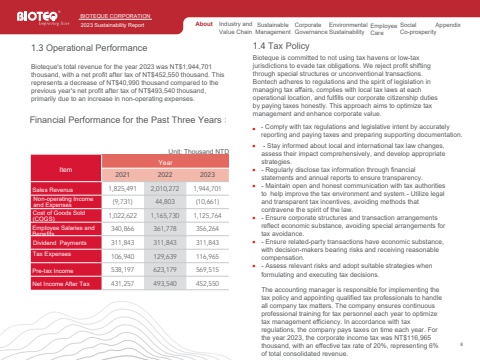

81.3 Operational PerformanceBioteque's total revenue for the year 2023 was NT$1,944,701 thousand, with a net profit after tax of NT$452,550 thousand. This represents a decrease of NT$40,990 thousand compared to the previous year's net profit after tax of NT$493,540 thousand, primarily due to an increase in non-operating expenses.Financial Performance for the Past Three Years%uff1aUnit: Thousand NTDItemYear2021 2022 2023Sales Revenus 1,825,491 2,010,272 1,944,701Non-operating Income and Expenses (9,731) 44,803 (10,661)Cost of Goods Sold(COGS) 1,022,622 1,165,730 1,125,764Employee Salaries and Benefits 340,866 361,778 356,264Dividend Payments 311,843 311,843 311,843Tax Expenses 106,940 129,639 116,965Pre-tax Income 538,197 623,179 569,515Net Income After Tax 431,257 493,540 452,5501.4 Tax PolicyBioteque is committed to not using tax havens or low-tax jurisdictions to evade tax obligations. We reject profit shifting through special structures or unconventional transactions. Bontech adheres to regulations and the spirit of legislation in managing tax affairs, complies with local tax laws at each operational location, and fulfills our corporate citizenship duties by paying taxes honestly. This approach aims to optimize tax management and enhance corporate value.- Comply with tax regulations and legislative intent by accuratelyreporting and paying taxes and preparing supporting documentation.%u2022 - Stay informed about local and international tax law changes,assess their impact comprehensively, and develop appropriatestrategies.%u2022 - Regularly disclose tax information through financialstatements and annual reports to ensure transparency.%u2022 - Maintain open and honest communication with tax authoritiesto help improve the tax environment and system.- Utilize legaland transparent tax incentives, avoiding methods thatcontravene the spirit of the law.%u2022 - Ensure corporate structures and transaction arrangementsreflect economic substance, avoiding special arrangements fortax avoidance.%u2022 - Ensure related-party transactions have economic substance,with decision-makers bearing risks and receiving reasonablecompensation.%u2022 - Assess relevant risks and adopt suitable strategies whenformulating and executing tax decisions.The accounting manager is responsible for implementing thetax policy and appointing qualified tax professionals to handleall company tax matters. The company ensures continuousprofessional training for tax personnel each year to optimizetax management efficiency. In accordance with taxregulations, the company pays taxes on time each year. Forthe year 2023, the corporate income tax was NT$116,965thousand, with an effective tax rate of 20%, representing 6%of total consolidated revenue.%u2022About Industry andValue Chain Sustainable ManagementCorporate GovernanceEnvironmental SustainabilityEmployee CareSocial Co-prosperityAppendixBBIOTEQUE CORPORATION2023 Sustainability Report