Page 46 - Demo

P. 46

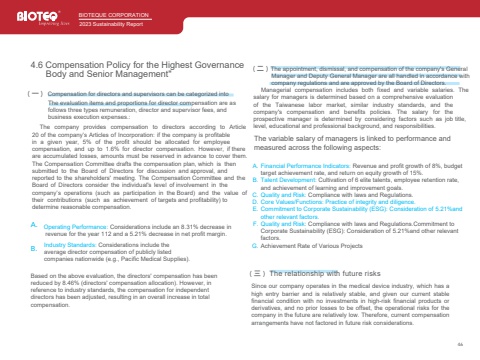

464.6 Compensation Policy for the Highest Governance Body and Senior Management\( %u4e00 ) Compensation for directors and supervisors can be categorized intoThe company provides compensation to directors according to Article 20 of the company%u2019s Articles of Incorporation: if the company is profitable in a given year, 5% of the profit should be allocated for employee compensation, and up to 1.6% for director compensation. However, if there are accumulated losses, amounts must be reserved in advance to cover them. The Compensation Committee drafts the compensation plan, which is then submitted to the Board of Directors for discussion and approval, and reported to the shareholders' meeting. The Compensation Committee and the Board of Directors consider the individual's level of involvement in the company%u2019s operations (such as participation in the Board) and the value of their contributions (such as achievement of targets and profitability) to determine reasonable compensation.The evaluation items and proportions for director compensation are asfollows three types remuneration, director and supervisor fees, andbusiness execution expenses.:A.B.( %u4e8c ) The appointment, dismissal, and compensation of the company's GeneralManager and Deputy General Manager are all handled in accordance withcompany regulations and are approved by the Board of Directors.Managerial compensation includes both fixed and variable salaries. The salary for managers is determined based on a comprehensive evaluation of the Taiwanese labor market, similar industry standards, and the company's compensation and benefits policies. The salary for the prospective manager is determined by considering factors such as job title, level, educational and professional background, and responsibilities.The variable salary of managers is linked to performance and measured across the following aspects:A. Financial Performance Indicators: Revenue and profit growth of 8%, budgettarget achievement rate, and return on equity growth of 15%.B. Talent Development: Cultivation of 6 elite talents, employee retention rate,and achievement of learning and improvement goals.C. Quality and Risk: Compliance with laws and Regulations.D. Core Values/Functions: Practice of integrity and diligence.E. Commitment to Corporate Sustainability (ESG): Consideration of 5.21%andother relevant factors.F. Quality and Risk: Compliance with laws and Regulations.Commitment toCorporate Sustainability (ESG): Consideration of 5.21%and other relevantfactors.G. Achievement Rate of Various ProjectsSince our company operates in the medical device industry, which has a high entry barrier and is relatively stable, and given our current stable financial condition with no investments in high-risk financial products or derivatives, and no prior losses to be offset, the operational risks for the company in the future are relatively low. Therefore, current compensation arrangements have not factored in future risk considerations.BBIOTEQUE CORPORATION2023 Sustainability ReportOperating Performance: Considerations include an 8.31% decrease in revenue for the year 112 and a 5.21% decrease in net profit margin.Industry Standards: Considerations include the average director compensation of publicly listed companies nationwide (e.g., Pacific Medical Supplies).Based on the above evaluation, the directors' compensation has been reduced by 8.46% (directors' compensation allocation). However, in reference to industry standards, the compensation for independent directors has been adjusted, resulting in an overall increase in total compensation.( %u4e09 ) The relationship with future risks